The ownership interest is calculated by dividing the number of shares a shareholder owns by the number of shares outstanding in the market. Shares include both common and preferred stock, but generally refer to common stock. Treasury shares are typically excluded from the denominator in this calculation, as they do not carry voting or dividend rights under corporate law. Therefore, the denominator is determined by subtracting treasury shares from the total shares issued by the company. The company's shareholder register usually provides the number of shares each shareholder owns and the number of shares outstanding, making it possible to calculate the ownership percentage.

If a shareholder's ownership percentage exceeds 50%, they generally become the controlling shareholder. For example, under Korean commercial law, decisions on the election of directors and profit distribution are made by an ordinary resolution of the general meeting of shareholders, which requires a majority of the voting rights of the shareholders present and at least one-quarter of the total issued shares. Thus, if a shareholder's ownership percentage exceeds 50%, they meet the requirements for an ordinary resolution and can freely influence the composition of the board of directors and profit distribution.

If the shareholder is a company, it becomes the parent company and enters into a special relationship concerning accounting and corporate tax law. Therefore, determining such ownership percentages is of significant importance in accounting and tax law.

Indirect ownership percentage refers to the percentage of ownership a company holds in a target company indirectly through another company. There is no consistent method for calculating the indirect ownership percentage. It can be calculated differently depending on the purpose. For example, if Company A owns 90% of Company B, and Company B owns 40% of Company C, Company A can be considered to own 36% of Company C, or 40%.

1) 36% Ownership Logic

Company A owns 90% of Company B, and Company B owns 40% of Company C, so Company A can be considered to own 36% (=90%×40%) of Company C indirectly. This calculation method appears mathematically valid but may not have significant accounting implications. For example, if Company A owns 40% of Company B, and Company B owns 80% of Company C, and Company A directly owns 20% of Company C, then Company A can be considered to own 52% (=40%*80%+20%) of Company C directly or indirectly. However, if Company B and Company A have conflicting opinions in a shareholders' meeting, Company A does not control Company B (since it owns less than 50% and is generally not considered to control it), Company B, having more voting rights in Company C, will have its opinion adopted, and as a result, the controlling company of Company C would be Company B, not Company A. However, Company A's direct or indirect ownership percentage in Company C would be 52%, which differs from the actual control determination.

2) 40% Ownership Logic

Company A controls Company B. As mentioned above, if a shareholder's direct ownership percentage exceeds 50%, the shareholder has a very high likelihood of determining the composition of the board of directors and profit distribution (unless otherwise specified). This shareholder is considered to control the company. Therefore, Company A controls Company B and can direct it to exercise its 40% stake in Company C at the shareholders' meeting of Company C. In other words, Company A can exercise 40% of the voting rights in Company C through Company B. If Company A does not control Company B (e.g., Company A owns only 40% of Company B), then Company A is considered to have an indirect ownership percentage of 0% in Company C in such a scenario. Company A might still have significant influence over Company C, but such influence cannot be measured by this calculation method.

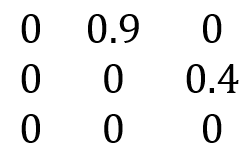

While the logic of (2) may be more meaningful in accounting, the logic of (1) holds more significance in tax law. This is because tax law requires precise numerical justification that everyone can accept, especially in situations of tax resistance. Furthermore, the ownership percentage according to the logic of (2) is easier to calculate because it simply follows the control chain treating ownership interests in the middle of the chain 100%, to determine the indirect ownership percentage. In this article, we will explore the method of calculating the indirect ownership percentage according to the logic of (1). To calculate the indirect ownership percentage based on the logic of (1), we will use mathematical matrices. We will refer to the ownership percentages listed in the target company's shareholder register as direct ownership percentages. First, let's represent the direct ownership percentages in a matrix form to make them computable. Rows represent owners and columns represent the owned entities. For example, row 1, column 2 would indicate the direct ownership percentage that Company 1 holds in Company 2. In the above example, if we represent Companies A, B, and C as Companies 1, 2, and 3 respectively, the situation where Company 1 owns 90% of Company 2 and Company 2 owns 40% of Company 3 can be represented in a direct ownership matrix with 90% in row 1, column 2, and 40% in row 2, column 3, with the rest being 0. Additionally, in this case, the sum of each column (1, 2, and 3) must be 1. This is because the total ownership percentages listed in the shareholder register must add up to 1. Note that this assumes a situation without treasury shares.

As a reference, if treasury shares exist, they can be represented in the diagonal elements of the matrix. For example, if Company 1 holds treasury shares, it means Company 1 holds itself, so the treasury share percentage will appear in row 1, column 1. Therefore, the ownership percentages in non-diagonal elements should be the pre-treasury-share percentages, and should be the ownership percentages divided by the total issued shares, not just the outstanding shares. This ensures that the sum of each column will be 1. Let's create the indirect ownership matrix based on this direct ownership matrix. There are methods for calculating the indirect ownership percentage that either consider or do not consider infinite circular shareholding. I will explain the calculation that considers infinite circular shareholding, but since this can result in direct or indirect ownership percentages exceeding 100%, I will mainly explain the method that does not consider infinite circular shareholding.

First, convert all diagonal elements of the matrix to 1. Even if there are treasury shares in the diagonal elements, disregard them and set the diagonal elements to 1. It will change as follows.

Then, perform matrix multiplication with the original direct ownership matrix.

Looking at this matrix multiplication, the resulting matrix is also a 3x3 matrix, where the element in row 1, column 3 of the resulting matrix represents the direct and indirect ownership percentage of Company 1 in Company 3. The product of the element in row 1, column 1 of the first matrix and the element in row 1, column 3 of the second matrix represents the direct ownership percentage of Company 1 in Company 3. The product of the element in row 1, column 2 of the first matrix and the element in row 2, column 3 of the second matrix represents the indirect ownership percentage of Company 1 in Company 3 through Company 2. The product of the element in row 1, column 3 of the first matrix and the element in row 3, column 3 of the second matrix represents the ownership percentage of Company 1 in Company 3's treasury shares. Changing the diagonal elements of the first matrix to 1 is done to include direct ownership in the calculation, while not changing them to 1 would only calculate the indirect ownership. The result of performing the matrix multiplication once is as follows:

We can see that the indirect ownership percentage of 36% for Company 1 in Company 3 is reflected in the matrix. In the example, the indirect ownership of Company 1 in Company 3 through Company 2 involves only one step, so we only needed to perform the matrix multiplication once. However, if the number of steps in the indirect ownership increases, we need to set the diagonal elements of the resulting matrix to 1 and then multiply it again by the direct ownership matrix, repeating this process until the resulting matrix converges and does not change from the previous iteration. For the given matrix, if we repeat the calculation, we will observe that the resulting matrix does not change. This is similar to the concept of a steady state in a Markov chain.

Interestingly, this is also reflected when treasury shares are involved. For example, if Company A owns 90% of Company B and Company B holds 10% of its own shares, Company A should be considered to effectively hold 100% ownership in Company B. Calculating the matrix multiplication, it appears as follows:

If the matrix calculation is repeated infinitely, it shows that Company 1 effectively owns 100% of Company 2, and Company 2 only holds 10% of its own shares.

What about the case of circular shareholding? Let's assume Company A owns 90% of Company B, and Company B owns 10% of Company A. To focus on the scenario, let's assume the remaining shares are held by a third party and are not considered. Korean commercial law has restrictions on voting rights for cross-shareholding, but Japan is known to have looser regulations compared to Korea. Therefore, such a situation is not inherently impossible.

First, representing this situation in matrices and calculating the result yields the following:

This resulting matrix means the following: Company A owns 90% of Company B, but because Company B owns 10% of Company A, it's as if Company A holds 9% of its own shares (=90%×10%). The same applies to Company B (=10%×90%). However, Company A only directly or indirectly holds a 90% ownership in Company B. When exercising voting rights or receiving dividends in Company B, Company A does not gain additional voting rights or dividend entitlements through the 9% of treasury shares. It can be interpreted that Company A has rights up to 90%, excluding the 10% owned by a third party in Company B.

However, from a mathematical perspective, it can be viewed as an infinitely recurring structure. That is, Company A doesn't just own 90% of Company B, but the 90% ownership in Company B also owns 10% of Company A (treasury share effect), and such an A again owns 90% of B, calculating this infinitely, we get 90% + 90%×9% (treasury share) + 90%×9%×9% + ... = 98.901...%, converging infinitely. This can be easily calculated using the sum formula for an infinite geometric series, where the first term is 90% and the common ratio is 9%. To implement this in matrix calculations, instead of converting the diagonal elements to 1, we add 1 to the diagonal elements of the matrix.

There are two issues with this method of infinite calculation. One is that, in reality, Company A only has the right to receive 90% of the dividends from Company B, yet the calculation shows it as having approximately 98.901% ownership. The second issue is that, with this method, ownership percentages exceeding 100% can result, which is counterintuitive since one company holding more than 100% ownership in another is conceptually difficult to understand. Therefore, instead of adding 1 to the diagonal elements, the method of converting the diagonal elements to 1 seems more meaningful in the context of actual corporate relationships.

Applying this ownership calculation method can also be used to implement control relationship chains. If Company 1 controls Company 2, represent this in the direct control matrix as 1 or True in row 1, column 2, and if it does not control, represent it as 0 or False. For such a direct control matrix, it is reasonable to represent the diagonal elements corresponding to treasury shares as all 0 or False. The calculation method is the same as the process of converting a direct ownership matrix to a direct and indirect ownership matrix, changing the diagonal elements to 1 until the matrix converges, and performing matrix multiplication with the direct control matrix, repeating the initial process on the resulting matrix. By doing so, one can derive the direct and indirect control matrix, from the direct control matrix, including the control of subsidiary companies.

Here is an example. Company A has a subsidiary, Company B, and Company B has a subsidiary, Company C.

Undergoing the same process as the transformation of the direct ownership matrix, the following results are obtained.

Thus, the element in row 1, column 3 of the resulting matrix changes to 1 (or True), indicating that Company C is an indirect subsidiary of Company A. This calculation can be easily implemented using the numpy library in Python. In the next post, we will apply this matrix to various analyses.

'Accounting' 카테고리의 다른 글

| Applications of Ownership Matrix and Control Matrix (0) | 2024.05.16 |

|---|